Trading Diary

July 25, 2002

These extracts from my daily trading diary are intended to

illustrate the techniques used in short-term trading and should

not be interpreted as investment advice. Full terms and

conditions can be found at

Terms

of Use .

USA

The Dow held on to yesterday's gains closing at 8186. The 8000

level may again act as support. Primary and secondary cycles

trend downwards.

The Chartcraft NYSE Bullish % Indicator has a

reading of 24% (July 24). See

Bullish % Index for more details.

The Nasdaq Composite slipped, closing 3.9% down at 1240.

Primary and secondary cycles are in a down-trend.

The S&P 500 closed down 0.5% at 838.

Primary and secondary cycles trend downwards.

AOL Time Warner

Stock in the media giant hit a 4-year low as the SEC probe into

accounting practices continues.

(more)

Chip stocks slide

Taiwan Semiconductor, the largest chip-maker, cuts new capital

expenditure as it faces a slow recovery.

(more)

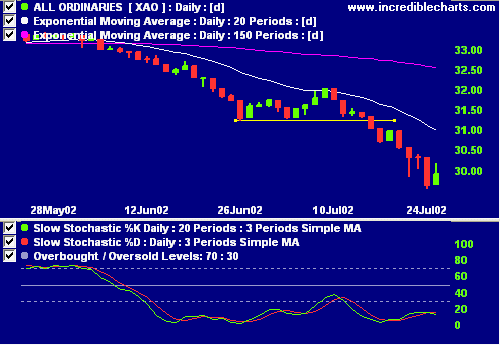

ASX Australia

The All Ordinaries recovered 26 points to close at 2991 on strong

volume.

Trading Diary

The primary cycle and secondary cycles trend down. The next

support level is 2828, from September 2001

Slow Stochastic (20,3,3) has joined the MACD (26,12,9), crossing

below its signal line. Exponentially-smoothed money flow signals

distribution.

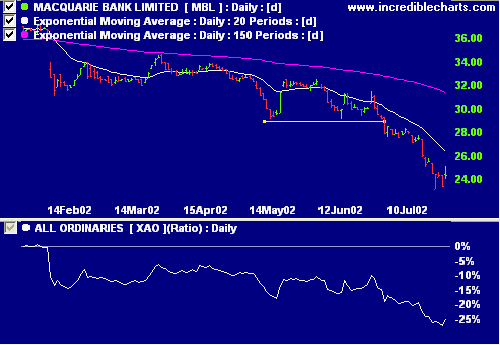

Macquarie Bank [MBL]

The bank's growth strategy is floundering in a weak market.

(more)

Relative strength (price ratio: xao), MACD and

exponentially-smoothed money flow are all weak.

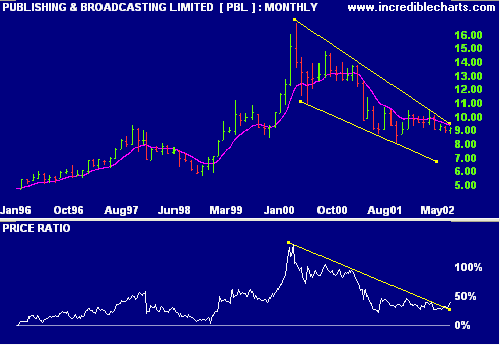

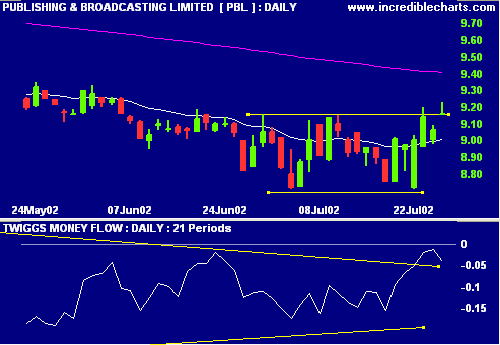

Publishing and Broadcasting Limited [PBL]

The PBL monthly chart shows a large falling wedge, a bullish

signal, while relative strength (price ratio: xao) appears to

be holding at current levels.

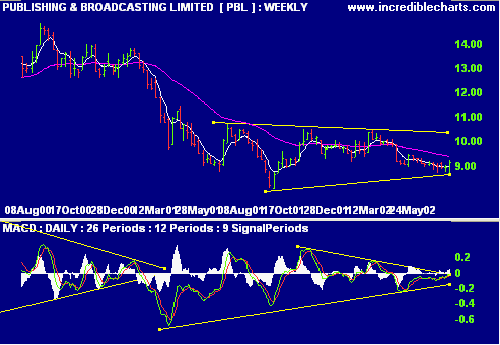

The weekly chart shows a smaller symmetrical triangle. MACD

is strengthening.

The daily chart shows a short-term double bottom but with

weak volume confirmation - Twiggs Money Flow has turned down

below zero.

Conclusion

Short-term: Short in selected areas. The Slow Stochastic and

MACD are below their respective signal lines. Keep stops

tight.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Nothing is illegal if a hundred businessmen decide to do

it - Andrew Young.

Back Issues

Back

Issues

Access the Trading Diary Archives.