Trading Diary

July 19, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow crashed more than 4.5% to close at 8019

on strong volume, just above the key 8000 support level. We are

now entering the third stage of the

bear market. Primary and secondary cycles trend

downwards.

The Nasdaq Composite lost 2.8% to close at

1319, below the 1357 October 1998 support level.

The primary and secondary cycles are in a down-trend.

The S&P 500 dropped 34 points to close at

847. The next support level is 804, from April 1997.

Primary and secondary cycles trend downwards.

Johnson & Johnson

J&J stock fell 16% on allegations of false

record-keeping at a plant that makes the Eprex anemia drug,

linked to serious side-effects. (more)

AOL Time Warner

AOL falls 7% after a management shakeout and resignation of COO

Bob Pittman.

(more)

Sun Micro

Sun Microsystems stock dropped 27% after

the company lowered 2003 revenue and earnings forecasts.

(more)

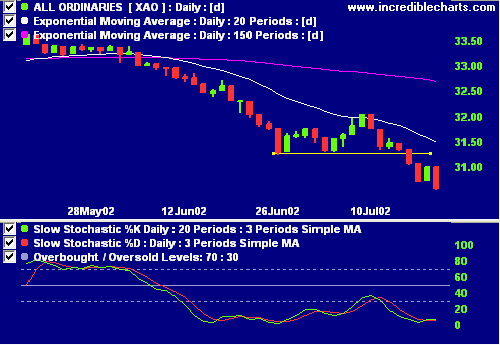

ASX Australia

Another drop of more than 1%, with the All Ordinaries closing

down 42 points at 3058 on above-average volume.

The primary cycle and secondary cycle

are in a bear trend.

Slow Stochastic (20,3,3) is above its signal line while MACD

(26,12,9) is below.

Exponentially-smoothed money flow signals distribution.

Brewers group

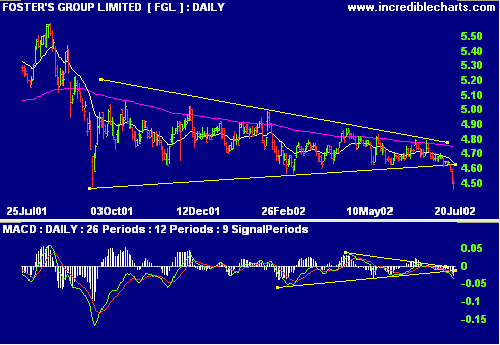

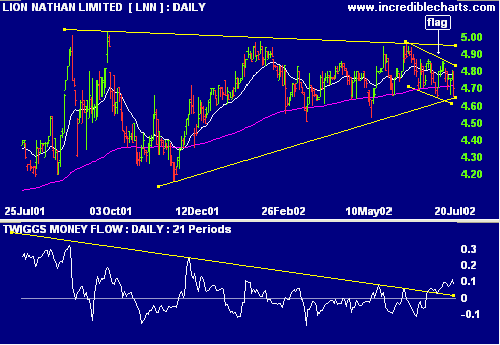

Fosters

[FGL] and Lion Nathan [LNN] have

enjoyed a year of "friendly" competition.

(more)

FGL has experienced a downward breakout from a symmetrical

triangle formed over the past 9 months. Relative Strength (price

ratio: xao) is improving, while MACD and exponentially-smoothed

money flow are negative.

LNN has formed a similar triangle but has not

yet made a breakout. Relative Strength (price ratio: xao) is

strong, MACD is neutral, while exponentially-smoothed money

flow signals accumulation during the recent flag

pattern.

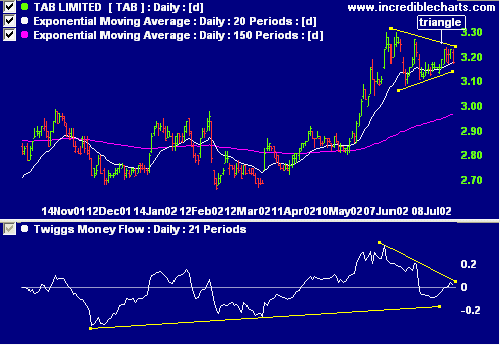

TAB [TAB]

TAB Limited has formed a congestion pattern that could be

described as a large pennant or small triangle.

Relative Strength (price ratio: xao) is positive but MACD has

turned back down. Exponentially-smoothed money flow signals

distribution over the period of the triangle pattern.

Sector Analysis

Stage changes are highlighted in

bold.

-

Energy [XEJ] - stage 1

-

Materials [XMJ] - stage 4 (RS is

rising)

-

Industrials [XNJ] - stage 4

-

Consumer Discretionary [XDJ] - stage

4

-

Consumer Staples [XSJ] - stage 4

-

Health Care [XHJ] - stage 4

-

Property Trusts [XPJ] - stage

3

-

Financial excl. Property Trusts [XXJ] -

stage 4

-

Information Technology [XIJ] - stage

4

-

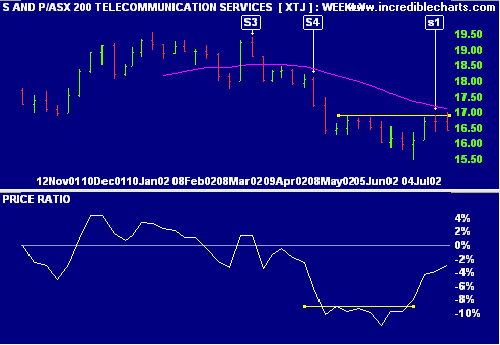

Telecom Services [XTJ] - stage 1 (RS is

rising)

-

Utilities [XUJ] - stage 1 (RS is

rising)

The ASX has ceased to provide the old ASX indices.

Sectors: Relative Strength

A stock screen of

equities using % Price Move (3 months: +10%) is dominated by:

-

Base Metals

-

Computer & Office

-

Diversified Media

-

Gold Explorers

-

Gold Producers

-

Mining Explorers

-

Miscellaneous Industrials

-

Miscellaneous Services

-

Oil & Gas Explorers

-

Oil & Gas Producers

Conclusion

Short-term: Avoid new entries. The Slow Stochastic is above, and

MACD below, its signal line.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

There are a few really outstanding

companies, whose stock normally sells at a substantial premium,

except in the final throes of a bear market.

Back Issues

Back

Issues

Access the Trading Diary Archives.