Trading Diary

July 18, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow lost a further 1.5% to close at 8409 on

above-average volume. The next key support level is 8000. This is

a

bear market, with primary and secondary cycles trending

down.

The Nasdaq Composite lost 2.9% to close at

1356. The index is at the October 1998 support level.

The primary and secondary cycles are in a down-trend.

The S&P 500 dropped 25 points to close at

881, below the October 1998 support level.

Primary and secondary cycles trend downwards.

Microsoft

Microsoft report fourth-quarter earnings of 43

cents per share, the same as a year ago. (more)

AMD

Advanced Micro Devices reported a second-quarter

loss of 54 cents per share, compared to 5 cents for the same

period last year.

(more)

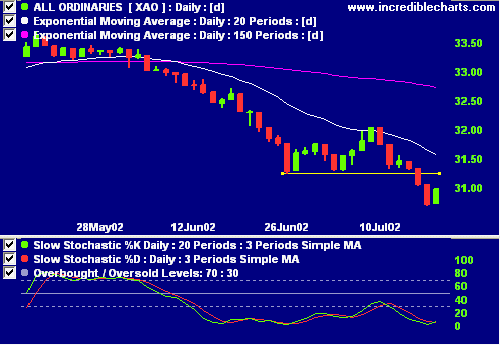

ASX Australia

The All Ordinaries closed up 27 points at 3100 on average volume.

The primary cycle and secondary cycle

are in a bear trend.

Slow Stochastic (20,3,3) has crossed to above its signal line.

Exponentially-smoothed Money Flow signals distribution.

Aussie dollar

The US dollar weakens along with the equity market.

(more)

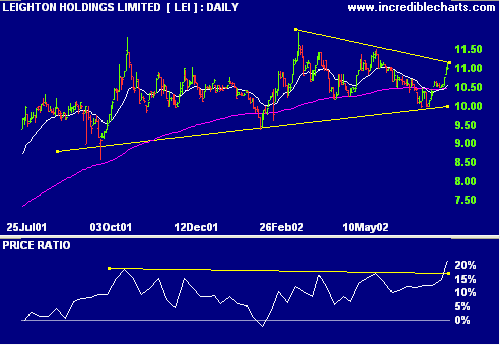

Leighton [LEI]

Australia's biggest contractor reports a record $ 8.4 billion of

work in hand.

(more)

The triangle (symmetrical) can either be a continuation or

reversal signal, depending on the breakout. Relative Strength

(price ratio: xao) is positive, while MACD and

exponentially-smoothed Money Flow are neutral.

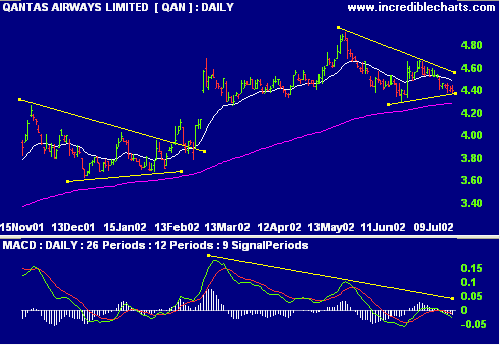

Qantas [QAN]

Qantas extols the benefits of a partnership with Air New

Zealand, fuelling speculation that QAN will acquire a

substantial stake in the carrier.

(more)

Another triangle: Relative Strength (price ratio: xao) is

positive but MACD and exponentially-smoothed Money Flow are

weak.

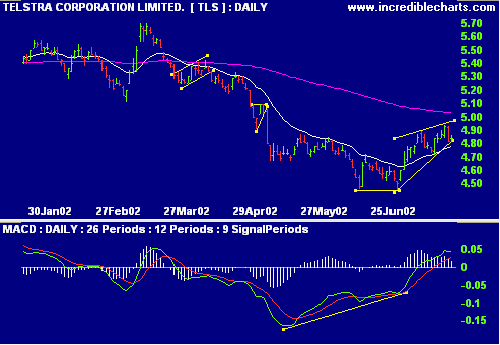

Telecom

Not many investors favorite sector at the moment, but worth

watching.

Telstra [TLS] is

approaching the target of 4.98 from the short double-bottom

pattern. The rising wedge is a bearish signal. The

150-day moving average is declining and relative strength

(price ratio: xao) is still weak but MACD and

exponentially-smoothed Money Flow are improving.

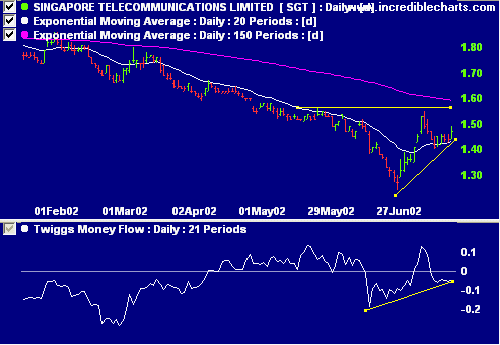

Singapore Telecom [STT] shows a bullish, ascending

triangle. A break above 1.55 would have a target of 1.86

(1.55 + (1.55 - 1.24)). The 150-day

moving average is declining and relative strength (price

ratio: xao) is still weak but MACD and

exponentially-smoothed Money Flow are

improving.

Conclusion

Short-term: Avoid new entries. The Slow Stochastic is above,

and MACD below, its signal line.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Small investors tend to be pessimistic and optimistic at

precisely the wrong times, so it's self-defeating to try to

invest in good markets and get out of bad ones. - Peter

Lynch

Back Issues

Back

Issues

Access the Trading Diary Archives.