Trading Diary

July 16, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow lost 1.9% to close at 8473 on strong

volume. The next key support level is 8000, from September

2001.

This is a bear market, with primary and secondary cycles trending down.

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite rallied in the morning

before closing down 0.5% at 1375, approaching support at 1357,

from October 1998.

The primary and secondary cycles are in a down-trend.

The S&P 500 fell 17 points to close at

900, below the October 1998 support level of 923.

Primary and secondary cycles trend downwards.

Intel

Second-quarter earnings missed recently

lowered forecasts and the chip-maker is to cut 4000 jobs

because of weak PC demand. (more)

Apple

The PC-maker reported June-quarter earnings per share down almost 50%, matching forecasts. (more)

The PC-maker reported June-quarter earnings per share down almost 50%, matching forecasts. (more)

Greenspan

The Fed chairman's testimony fails to lift the markets.

(more)

ASX Australia

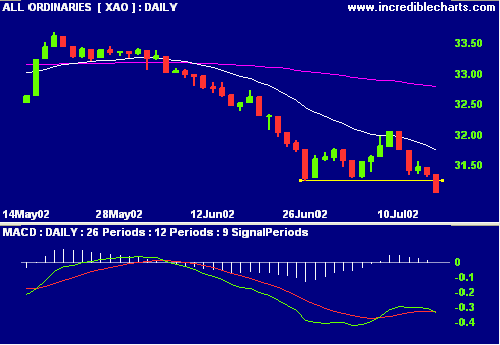

The All Ordinaries closed below the 3130 support level at 3107,

down 28 points on normal volume.

The primary cycle is in a bear trend. The secondary cycle has

resumed its down-trend.

MACD (26,12,9) has joined Slow Stochastic (20,3,3) below its

signal line.

Exponentially-smoothed Money Flow signals distribution.

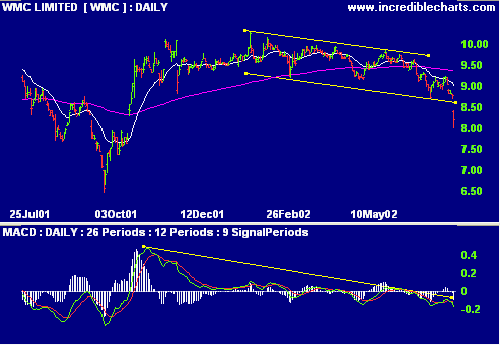

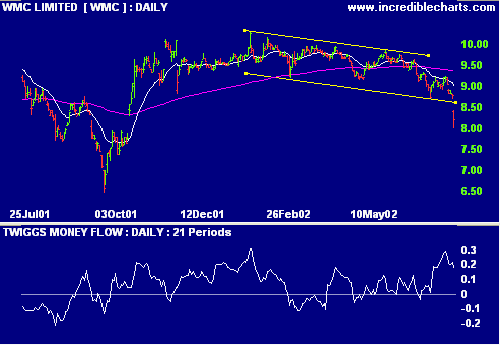

WMC angers analysts [WMC]

WMC issues an earnings warning, due to increased production

downtime at Olympic Dam copper mine, shortly after analysts were

given an upbeat tour of the mine. (more)

Relative Strength (price ratio: xao) and MACD are weak, while

exponentially-smoothed Money Flow still signals accumulation.

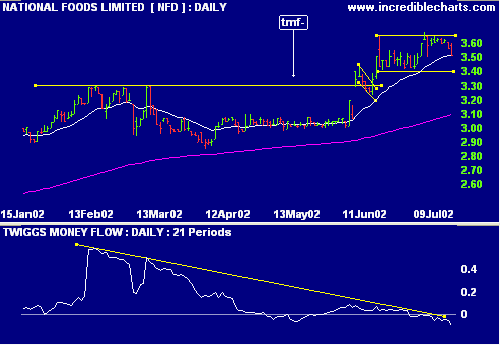

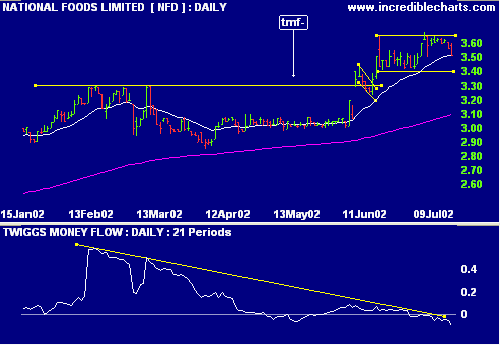

National Foods [NFD]

After breaking above resistance at 3.30, NFD has traded in a

narrow range.

Relative Strength (price ratio: xao) is strong but

exponentially-smoothed Money Flow and MACD show bearish

divergences.

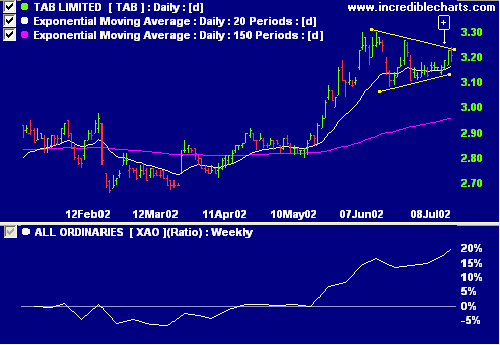

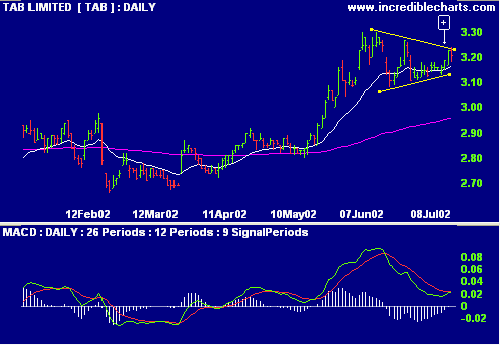

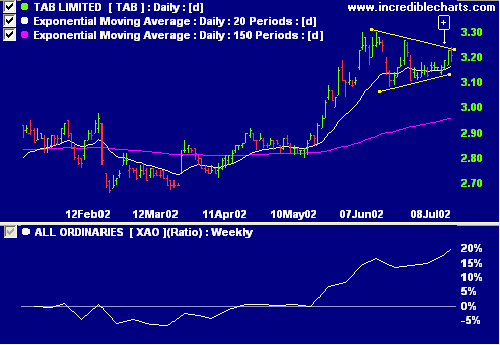

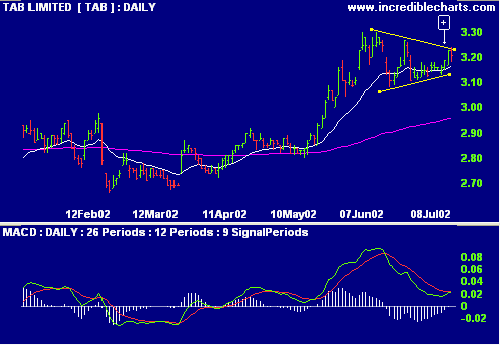

TAB Limited [TAB]

Back Issues

TAB has formed a pennant (lower highs and higher lows) after

a strong up-trend. Relative Strength (price ratio: xao) is

rising, exponentially-smoothed Money Flow is improving, while

MACD has swung up while above zero.

Conclusion

Short-term: Short in selected

sectors. The Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

If you can keep your head. When all about you are losing theirs. - Rudyard Kipling

If you can keep your head. When all about you are losing theirs. - Rudyard Kipling

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.