Trading Diary

July 9, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell another 1.9% to close at 9096 on

above-average volume.

This is a bear market, with primary and secondary cycles trending down.

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite fell 1.74% to close at

1381.

The primary and secondary cycles are in a down-trend.

The S&P 500 lost 24 points to close at

952.

Primary and secondary cycles trend downwards.

Wyeth leads drug sector lower

Safety concerns over the group's

hormone-replacement drug caused a fall to a 2-year low.

(more)

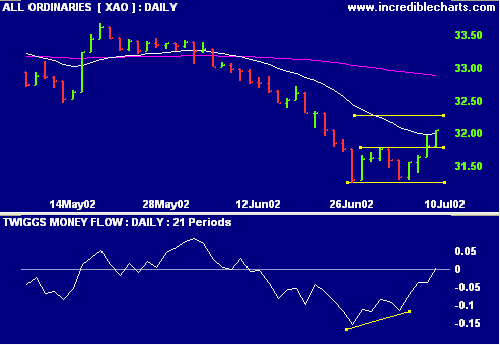

ASX Australia

The All Ordinaries closed up 7 points at 3205

on average volume. The completed double-bottom pattern has a

target of 32.30.

The primary cycle is in a bear trend,

secondary cycle has completed a

reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are

above their signal lines.

Exponentially-smoothed

Money Flow has returned to positive territory.

Business confidence falls

The NAB monthly survey shows a sharp fall in

business confidence. (more)

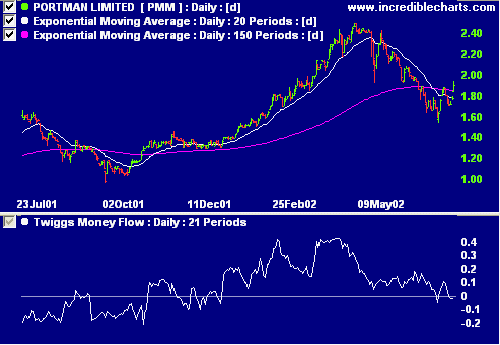

Portman [PMM]

Iron ore miner Portman has concluded an important native title

agreement that will allow it to double production. (more)

Relative Strength (price ratio: xao) and MACD are improving, while exponentially-smoothed Money Flow signals accumulation.

Relative Strength (price ratio: xao) and MACD are improving, while exponentially-smoothed Money Flow signals accumulation.

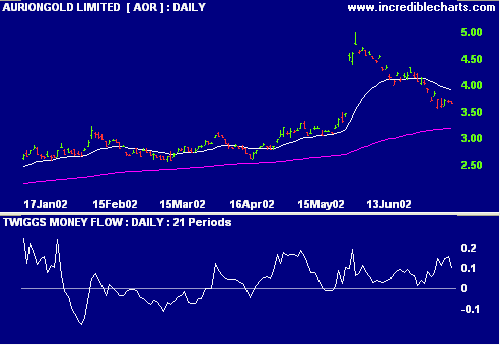

AurionGold [AOR]

AOR is one of the few gold stocks that

continues to signal accumulation (on exponentially-smoothed Money Flow) during the current

correction.

Relative Strength (price ratio: xao) and MACD

are still weak.

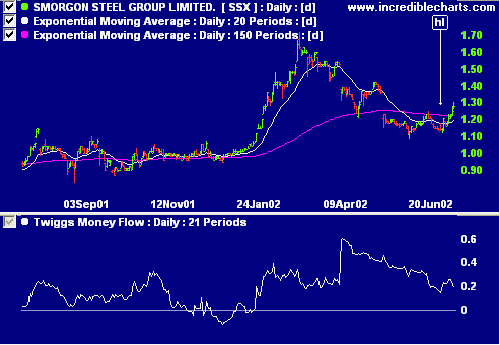

Smorgon Steel [SSX]

Back Issues

SSX has signaled strong accumulation (on

exponentially-smoothed Money Flow) over the last year.

Relative Strength (price ratio: xao) and

MACD are improving.

Conclusion

Short-term: We have a signal to go long - the Slow Stochastic

and MACD are above their respective signal lines. Exercise

extreme caution because of the weakness in US markets.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day

"The trend is your friend until it bends near the end" - Ed Seykota.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.