Trading Diary

July 4, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

Markets were closed for Independence Day

holiday.

Three killed at El Al

Three people were killed when a gunman opened

fire at an El Al Airlines ticket counter at Los Angeles

International Airport. (more)

AMD

Chip-maker AMD cut second-quarter sales forecasts for the second

time. (more)

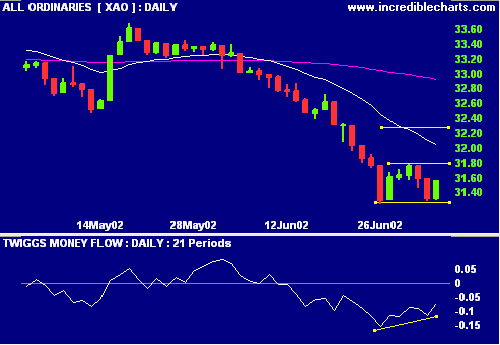

ASX Australia

The All Ordinaries gained 24 points to close at

3157 on average volume.

A rise above 31.80 would complete a short

double-bottom pattern with a target of 32.30.

Primary and secondary cycles are in a bear

trend.

Slow Stochastic (20,3,3) and MACD (26,12,9) are

below their signal lines.

Exponentially-smoothed

Money Flow shows a slight bullish divergence.

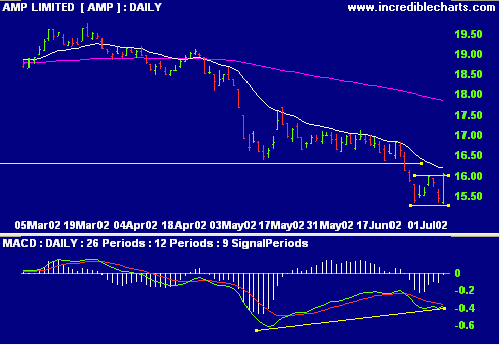

AMP [AMP]

AMP rises on speculation that it may be an

NAB acquisition target. (more)

The stock has completed a short double-bottom pattern with a target of $16.70.

The stock has completed a short double-bottom pattern with a target of $16.70.

MACD shows a bullish divergence, while

Relative Strength (price ratio: xao) and exponentially-smoothed

Money Flow are still weak.

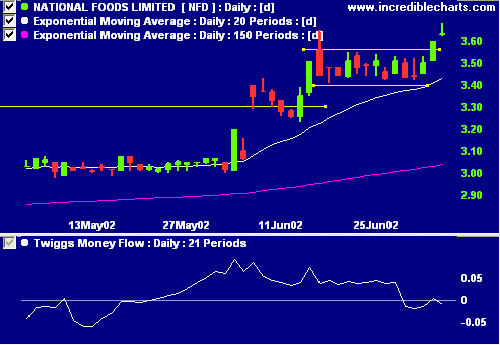

National Foods [NFD]

NFD gapped up to a new high but on lower

volume. (Readers note: traders often move their stop-losses

up to the bottom of the trading gap as there is a high

probability that a breakaway gap will not be closed).

Relative Strength (price ratio: xao) and

MACD are bullish but exponentially-smoothed Money Flow did

not like the weak close.

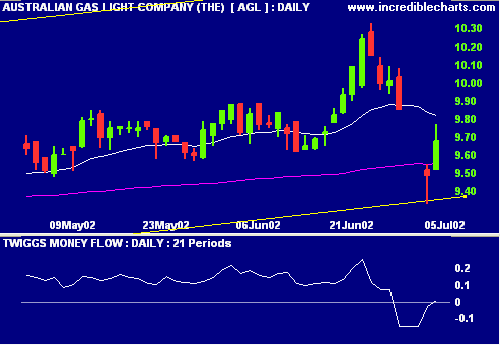

Australian Gas Light [AGL]

Back Issues

AGL bounced back above the channel line

depicted yesterday. Exponentially-smoothed Money Flow has

moved into positive territory, signaling accumulation.

Relative Strength (price ratio: xao) is improving, but MACD

is weakening.

Alesco [ALS]

ALS has failed to break through resistance at $3.95 on the first attempt.

ALS has failed to break through resistance at $3.95 on the first attempt.

Conclusion

Short-term: Short - the Slow

Stochastic and MACD are below their signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P

500 (primary cycle).

Colin Twiggs

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.