Trading Diary

June 25, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The slide continues, with the Dow falling 1.7%

to close at 9126 on above-average volume.

This is a

bear market, with primary and secondary

cycles trending down.

The Nasdaq Composite dropped 2.5% to close at

1423, testing September 2001 support levels.

The primary and secondary cycles trend downwards.

The S&P 500 lost 16 points to close at

976, approaching support at 960.

Primary and secondary cycles continue downwards.

General Electric

After market hours, GE announced that second

quarter earnings will match forecasts. (more)

Procter & Gamble leads decline

Market favorite P&G lost

5%, making the biggest contribution to the Dow's fall.

(more)

ASX Australia

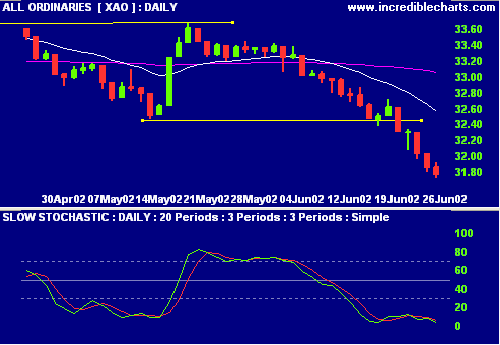

The All Ordinaries dropped 9 points to close at

3177 on strong volume.

The primary and secondary cycles are in a bear

trend.

MACD (26,12,9) and Slow Stochastic (20,3,3) are

below their signal lines.

Chaikin Money Flow signals distribution.

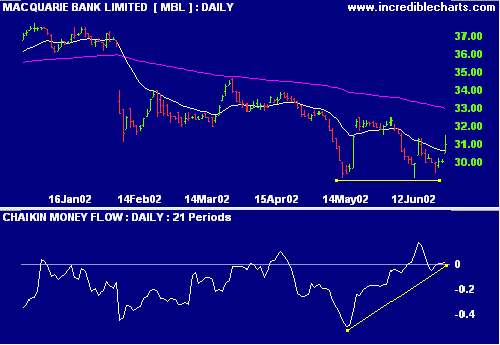

Macquarie Bank [MBL]

MBL will collect $50 million in fees from

the successful $5.6 billion bid for Sydney Airport.

(more)

Relative Strength (price ratio: xao) is

rising, while MACD and Chaikin Money Flow show bullish

divergences.

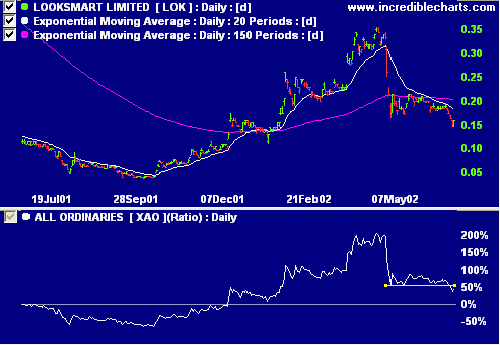

Looksmart boardroom turmoil

[LOK]

Evan Thornley steps down as CEO but remains

as Chairman, while 3 other directors quit.

(more)

MACD and Relative Strength (price ratio:

xao) are weak, while Chaikin Money Flow is positive.

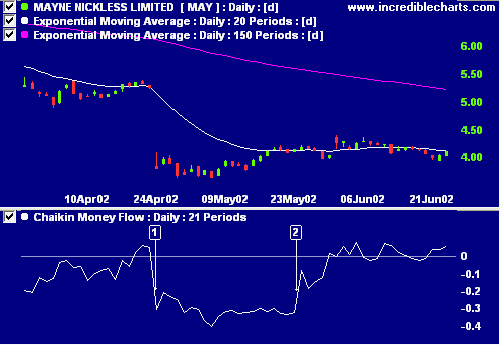

Mayne Group [MAY]

Mayne seeks to expand its healthcare

division through the acquisition of Queensland Medical

Laboratory. (more)

MACD and Relative Strength (price ratio:

xao) appear weak, while Chaikin Money

Flow has returned to positive territory.

Chaikin Money Flow has one major flaw

to watch out for: Note the sharp fall [1] on April 24th,

when price gapped downward. 21 days later at [2], when

the downward gap is dropped from the indicator window,

Chaikin MF rises steeply. Indicators calculated with a

simple moving average have this propensity to "bark

twice" - first when the data "arrives" and later when

it "leaves".

I have been working on an improvement

to eliminate this flaw.

Conclusion

Short-term: Short in selected sectors -

MACD and slow Stochastic are below their signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.