Trading Diary

June 21, 2002

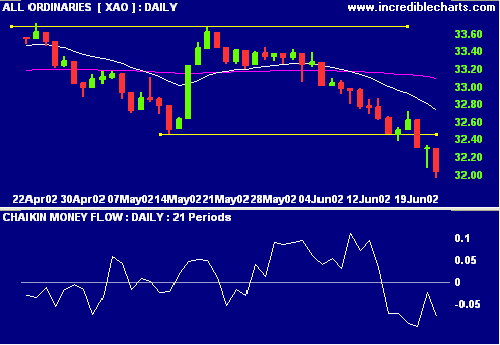

Primary and secondary cycles trend downwards, in a bear market.

The Nasdaq Composite dropped 1.6% to 1440,

close to the 1400/1425 support level from September last

year.

The primary and secondary cycles are in a down-trend.

The S&P 500 lost a further 17 points to

close at 989 - approaching the 960 target from the double-top

pattern completed

May 6th.

Primary and secondary cycles trend downwards.

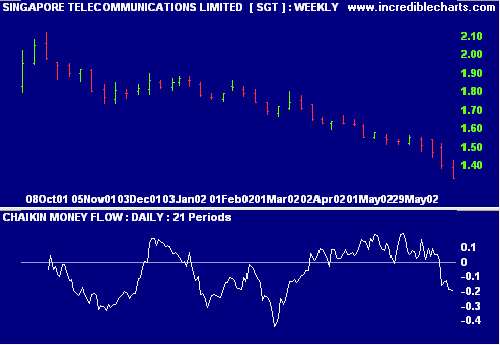

SingTel [SGT] charts paint a similar picture.

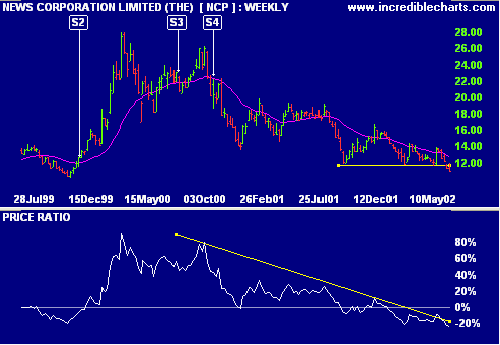

NewsCorp [NCP]

NCP

continues its stage 4 decline, having broken below

support at $11.80. Chaikin MF, MACD and Relative Strength

all show weakness.

Sector Analysis

I have

grouped the old ASX sectors under their new GICS

headings. This not 100% accurate - some stocks have been

re-classified. The [%] after the heading is a rough guide

to the size of the sector as a percentage of the total

market.

Energy [3%] - stage 1

Energy (XEY) - stage 4

Materials [15%] - stage 3

Gold (XGO), Paper & Packaging (XPP),

Chemicals (XCE) - stage 2

Building Materials (XBM), Other Metals (XOM) - stage

3

Diversified Resources (XDR) - stage 4

Industrials [7%] - stage 4

Engineering (XEG) and Transport (XTP) -

stage 3

Diversified Industrials (XDI) - stage 4

Consumer Discretionary [17%] - stage 4

Tourism & Leisure (XTU) -stage

2

Media (XME) - stage 4

Consumer Staples [7%] - stage 3

Food & Household Goods (XFH) - stage

2

Retail (XRE) - stage 3

Alcohol & Tobacco (XAT) - stage 4

Health Care [3%] - stage 4

Health & Biotech (XBH) - stage 4

Property Trusts [5%] - stage 2

Property Trusts (XPT) - stage 2

Financial excl. Property Trusts [31%] - stage 2

Banks & Finance (XBF) - stage

2

Investment & Financial Services (XIF), Developers

(XDC) and Insurance (XIN) - stage 4

Information Technology [1%] - stage 4

Miscellaneous Industrials (Technology) (XMI) - stage 1

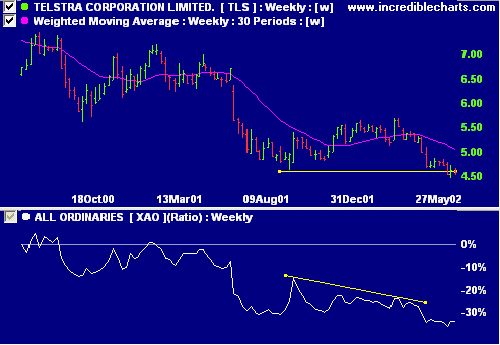

Telecom Services [10%] - stage 4

Telecom (XTE) - stage 4

Utilities [1%] - stage 1

Infrastructure Utilities (XIU) - stage 4

Note the differences between the stage

analysis of Energy and Utilities under the old and new

systems - due to re-classification.

At the end of June the ASX will cease to provide the old

ASX indices. We are endeavoring to find other

sources.

Sectors: Stock Screens

A

stock screen of equities using % Price Move (1 month:

+10%, 1 year: +30%) is dominated by Gold Producers, Gold

Explorers, Mineral Sands, Mining Explorers, and Oil

& Gas stocks.

A stock screen of equities using % of High (1 year: 100% minimum) reveals a number of Gold stocks, Equity Investors and Property stocks making new highs.

Colin Twiggs

Back Issues