Trading Diary

June 19, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell 1.5% to close at 9561 on

above-average volume.

The index is making another test of the 9500 support level. The primary and secondary cycles trend downwards.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The index is making another test of the 9500 support level. The primary and secondary cycles trend downwards.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite dropped 3% to close at

1493.

The primary cycle is in a bear trend. The short cycle has made

a higher peak but the secondary cycle is still in a

down-trend.

The S&P 500 lost 18 points to close at

1019.

Primary and secondary cycles trend downwards.

Morgan Stanley

Morgan Stanley reports a 14%

fall in fourth-quarter earnings. Only investment banks focused on

fixed-income business have benefited from the current

market. (more)

Tech stocks

Tech stocks are dumped after

AMD, Apple and Intel lower forecasts and the FTC files

anti-trust charges against Rambus. (more)

ASX Australia

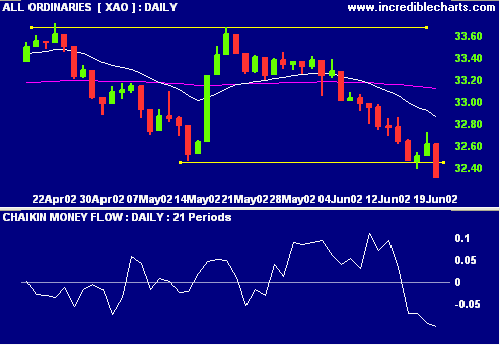

The All Ordinaries fell sharply to close 31

points down at 3231, on average volume.

The fall below the 3250 support level signals

the start of a primary bear trend.

Chaikin Money Flow continues to decline,

signaling distribution.

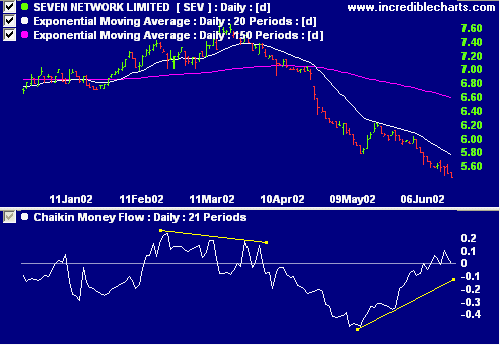

Seven [SEV]

Seven Network acquires full control of

Pacific Magazines. (more)

SEV is in a bear trend, with Relative

Strength (price ratio: xao) and MACD negative, while

Chaikin Money Flow shows a bullish divergence.

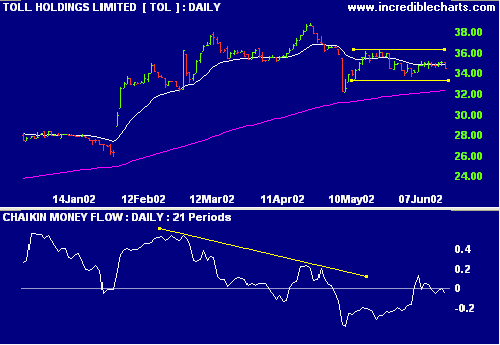

Toll Holdings [TOL]

Toll MD Paul Little expresses interest

in Mayne transport logistics business. (more)

TOL is in a ranging market with no clear

direction. Chaikin Money Flow showed a bearish divergence

in April after 8 months of consistent accumulation.

Relative Strength (price ratio: xao) is weakening, while

MACD gives conflicting signals.

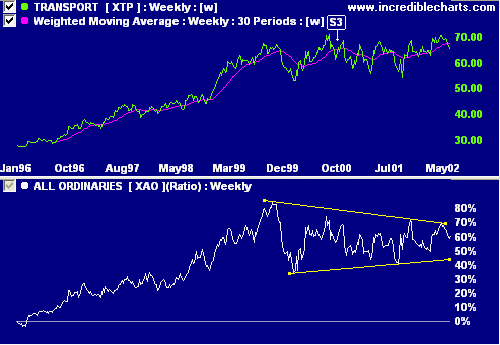

Sectors: Transport

The XTU index has been in a Stage 3 [S3]

ranging market since October 2000.

Sectors: Gold

The primary bull-trend continues.

Short-term: No signals yet from the Detrended Price

Oscillator and Chaikin MF.

Conclusion

Short-term: Short on completion of MACD/Slow

Stochastic signal - selected sectors only. The break below 3250

signals the start of a primary bear trend.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.