Trading Diary

June 12, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow recovered 1% to 9617 on very strong

volume.

Another successful test of the 9500 - 9600 support level. A break

below this level will complete a broad

head and shoulders pattern and signal a primary

bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull

correction signal, warning investors to adopt defensive

strategies.

The Nasdaq Composite rallied 1.5% to

1519.

The primary and secondary cycles trend downwards.

The S&P 500 rose 7 points to 1020.

Primary and secondary cycles trend downwards.

Proctor & Gamble

The makers of Tide and Pampers

raised their fourth-quarter earnings forecasts.

(more)

Late rally

A late rally in Intel and

Microsoft lifts stocks. (more)

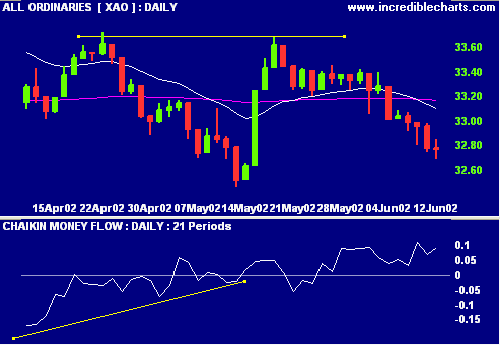

ASX Australia

The All Ordinaries eased 1 point to 3277 on

above-average volume, signaling accumulation.

Chaikin Money Flow continues to rise, signaling

accumulation.

The primary trend is up, secondary trend -

down.

MACD (26,12,9) and Slow Stochastic (20,3,3)

are below their signal lines.

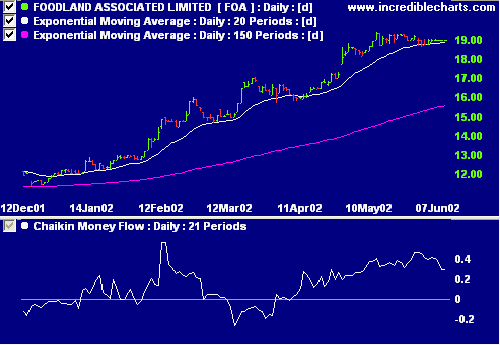

Court injunction against Foodland [FOA]

Competitor, Foodstuffs (Auckland) Ltd, last

night obtained an interim order preventing Perth-based

Foodland from taking further action in it's acquisition of

Woolworths New Zealand. (more)

FOA shows strong Relative Strength

(price ratio: xao), Chaikin Money Flow shows accumulation,

while MACD signals a bearish divergence.

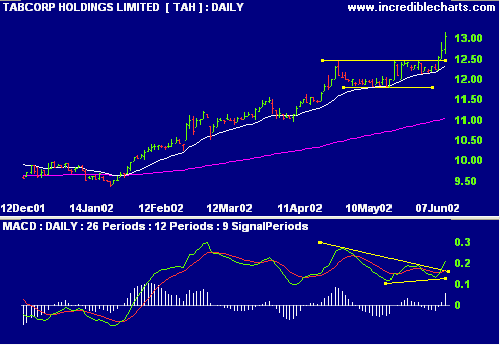

Tabcorp [TAH]

The Victorian government doubled the limit

on individual shareholding to 10% and raised the

restriction on foreign ownership to 40%. (more)

TAH has broken out above resistance at

$12.50. Relative Strength (price ratio: xao) is strong,

while MACD and Chaikin Money Flow have recovered.

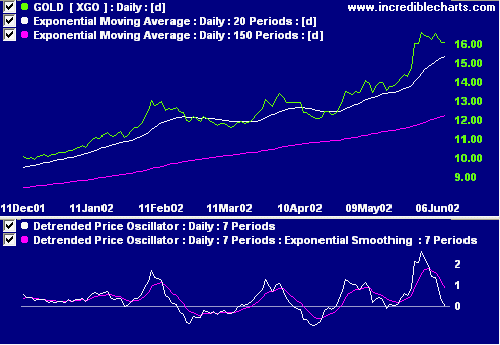

Gold

XGO continues to weaken.

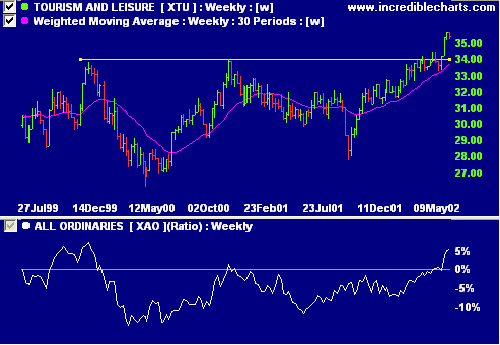

Sectors: Tourism &

Leisure

The XTU index is in the middle of a

bull trend, largely due to the Casinos & Gaming

sector.

Relative Strength (price ratio: xao), MACD and Chaikin

Money Flow are strong.

Conclusion

Short-term: Avoid long. Expect a reversal

shortly.

Medium-term: Wait for the All Ords to signal a

secondary cycle reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.