Trading Diary

June 11, 2002

The average is again testing support at 9500. A break below this level will signal a primary bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite fell sharply to close at

1497.

The primary and secondary cycles trend downwards.

The S&P 500 fell 17 points to close at

1013.

Primary and secondary cycles trend downwards.

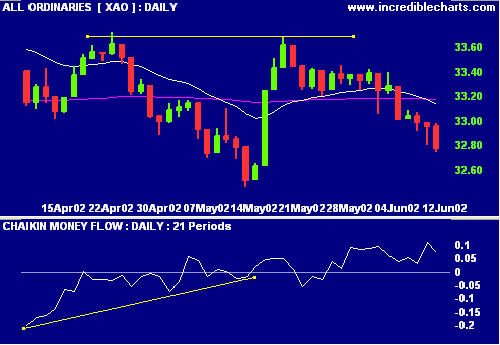

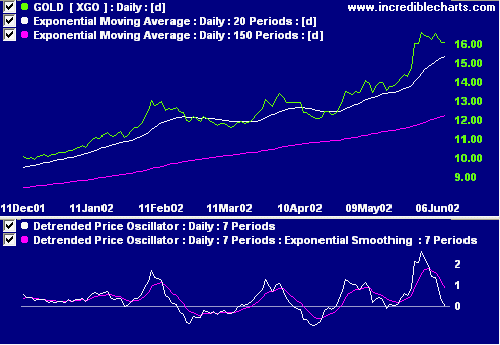

Wait for Detrended Price Oscillator and Chaikin MF signals before entering short trades.

Sectors

Analysis of ASX

sectors reveals the following

stages:

Growth Sectors

-

Stage 1 possible recoveries - Media (XME), Telecom (XTE) and Technology (XMI)

-

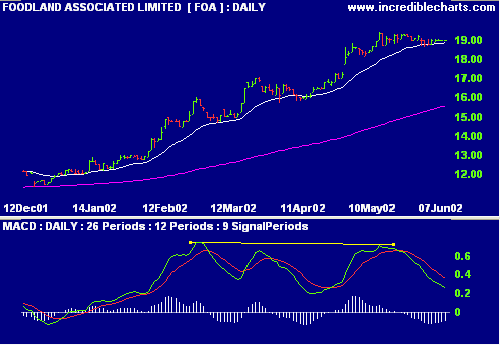

Stage 2 bull trends - Banks & Finance (XBF) [advanced]

-

Stage 3 possible reversals - Retail (XRE) and Transport (XTP)

-

Stage 4 bear trends - Developers (XDC), Insurance (XIN), Alcohol & Tobacco (XAT), Health & Biotech (XBH) and Diversified Resources (XDR).

Cyclicals

-

Stage 2 bull trends - Gold (XGO), Paper & Packaging (XPP) and Chemicals (XCE) [advanced]; Tourism & Leisure (XTU) [early]

-

Stage 3 possible reversals - Building Materials (XBM) and Energy (XEY)

-

Stage 4 bear trends - Engineering (XEG) and Diversified Industrial (XDI).

At the end of June the ASX will cease to provide detailed sector indices. We will endeavor to find other sources.

Colin Twiggs

Back Issues