Trading Diary

June 7, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell to 9472 before rallying back to

9589 on very strong volume. Another successful test of the 9500

support level.

A break below 9500 will signal a primary bear-trend. The secondary cycle trends downwards.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

A break below 9500 will signal a primary bear-trend. The secondary cycle trends downwards.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

After a weak opening the Nasdaq Composite

rallied during the day but still closed 1.25% down at

1535.

The primary and secondary cycles continue downwards.

The S&P 500 closed 2 points down at

1027.

Primary and secondary cycles trend downwards.

Unexpected fall in unemployment

Unemployment levels fell to

5.8% from a high of 6%. (more)

Intel down 19%

Intel and AMD lead a general

tech stock decline after Intel's revenue downgrade.

(more)

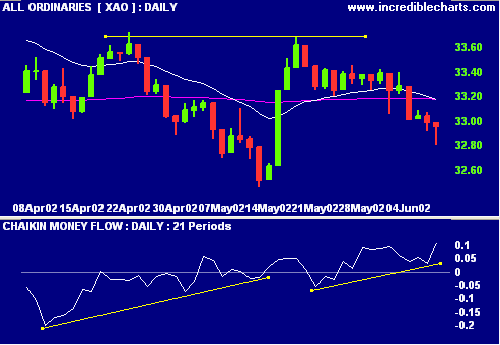

ASX Australia

The All Ords recovered from a sharp morning fall

to close 3 points down at 3296 on average volume.

The primary trend is up, secondary trend - down.

A break above 3370 would complete an

inverted head and shoulders pattern.

MACD (26,12,9) and Slow Stochastic (20,3,3) are

below their signal lines.

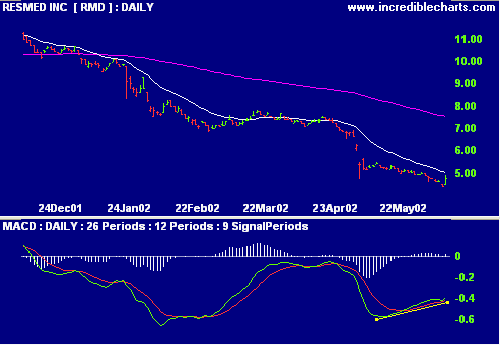

ResMed [RMD]

The announcement of a share buy-back was

favorably received by the market. (more)

RMD closed up at $4.76 with bullish

divergences on MACD and Chaikin MF, while Relative Strength

(price ratio: xao) is still weak.

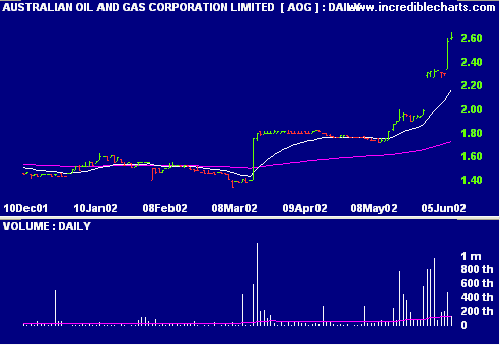

AOG [AOG]

The directors of Australian

Oil & Gas Corp. intend to recommend that shareholders

accept the $2.50 per share takeover offer by Texas-based Parker

Drilling. (more)

AOG closed at $2.65.

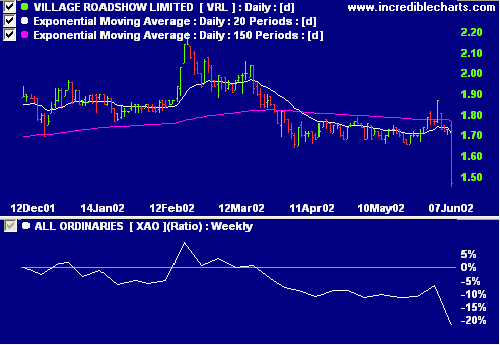

Village Roadshow [VRL]

The cinema group announces

plans to scrap dividends "for an extended period of time".

(more)

VRL fell to $1.45 after a bearish divergence on Chaikin MF and weak Relative Strength (price ratio: xao).

VRL fell to $1.45 after a bearish divergence on Chaikin MF and weak Relative Strength (price ratio: xao).

Conclusion

Short-term: Avoid long. Maintain tight

stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.