Trading Diary

June 4, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow tested resistance at 9600 before

rallying to 9687 on strong volume, as buyers re-entered the

market.

The index has broken through the 9800 support level. On reflection, I believe that it would be conservative to treat this as a secondary cycle movement and to call a primary bear-trend if the index breaks below support at 9500. Identifying the secondary cycle is difficult when the market does not show a clear trend.

The index has broken through the 9800 support level. On reflection, I believe that it would be conservative to treat this as a secondary cycle movement and to call a primary bear-trend if the index breaks below support at 9500. Identifying the secondary cycle is difficult when the market does not show a clear trend.

The Nasdaq Composite recovered 1% to close at

1578.

The primary and secondary cycles continue to trend

downwards.

The S&P 500 closed unchanged at 1040.

Remember, the pattern completed on

May 6th has a target of 960.

The primary and secondary cycles trend downwards.

IBM

IBM expects to take a charge of

$US 2.5 billion as it extricates itself from hard disk

manufacturing. (more)

Greenspan gives comfort

Alan Greenspan says that the

US economy is showing positive signs but "it's not going to be

a dramatic upswing". (more)

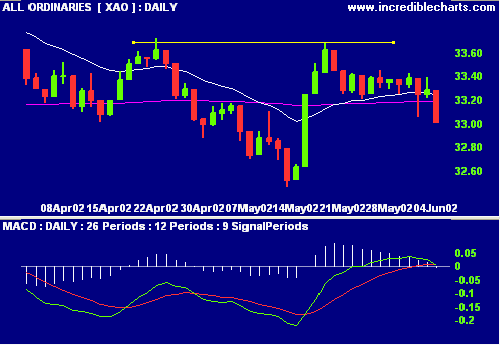

ASX Australia

The All Ords fell sharply to close at 3301 on

regular volume, signaling that buyers are scarce.

The primary trend is up, secondary trend - down.

A break above 3370 would complete an

inverted head and shoulders pattern.

Chaikin Money Flow is declining, signaling

distribution.

MACD (26,12,9) has joined Slow Stochastic

(20,3,3) below its signal line.

Rates rise and strong dollar expected

The RBA is expected to announce a rise of at

least 0.25% in official interest rates today, with a positive

effect on the dollar. (more)

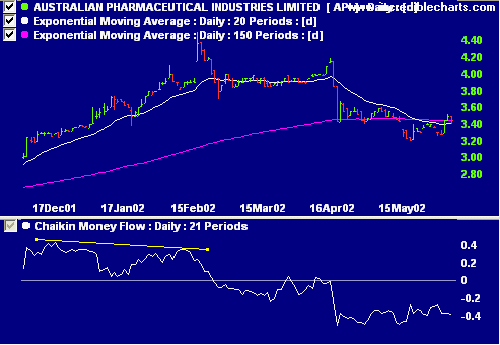

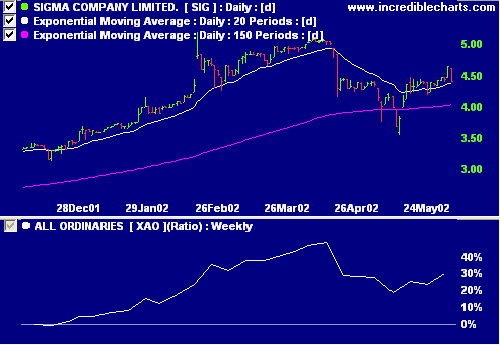

Drug rivals seek merger [SIG]

Australian Pharmaceutical Industries and

Sigma continue to seek a merger, despite the previous

rejection by the ACCC. (more)

Both stocks have weak Relative Strength

(price ratio: xao), MACD and Chaikin MF.

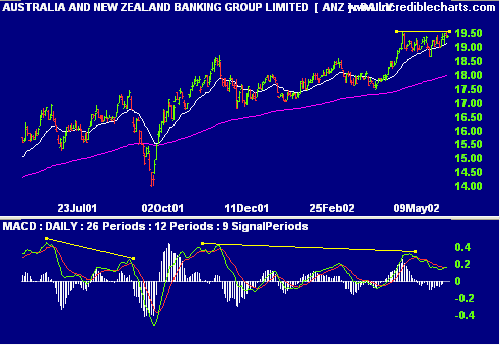

ANZ outlook [ANZ]

Salomon Smith Barney upgrade

ANZ to "outperform" despite the expected rise in interest

rates. (more)

The stock is running into resistance at 19.50.

MACD is a bit weak but Relative Strength (price ratio: xao) and

Chaikin MF are strong.

Gold powers on

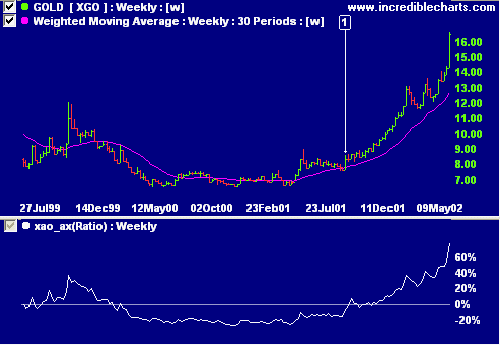

The gold index XGO surges ahead. The 30-week

weighted MA is rising steeply and Relative Strength (price

ratio: xao) continues to make new highs.

Conclusion

Short-term: Avoid long. Maintain tight

stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.