Trading Diary

May 29, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow weakened further, closing at 9923 on

average volume.

The secondary down-trend continues but will have to break through the 9800 and 9500 support levels to start a primary bear-trend.

The secondary down-trend continues but will have to break through the 9800 and 9500 support levels to start a primary bear-trend.

The Nasdaq Composite fell 1.6% to close at

1624.

The primary and secondary trends are down.

The S&P 500 closed down 7 points at

1067.

The primary and secondary cycles are trending downwards.

Brewing giant

South African Breweries plc is

set to buy Miller Brewing Co. from Phillip Morris, to become the

world's second-largest brewer. (more)

US dollar falls against euro

The US dollar reached a

14-month low against the euro as confidence in a rapid US

recovery wanes. (more)

Gold outlook

Despite a bout of selling, June gold futures

rallied to close above $US 325 per ounce. (more)

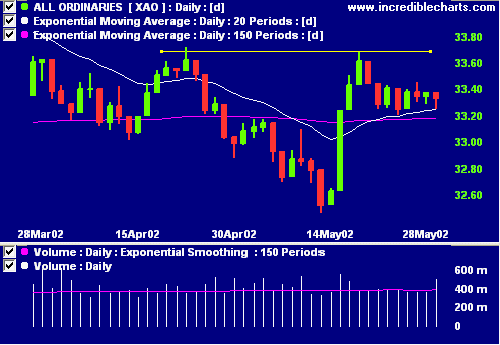

ASX Australia

The All Ords closed down 5 points at 3333 on

strong volume.

The primary trend is up, secondary trend - down.

A break above 3370 would complete an

inverted head and shoulders pattern.

Chaikin Money Flow signals accumulation.

Slow Stochastic (20,3,3) and MACD are above

their respective signal lines.

Dollar rises

The Australian dollar reaches new 16-month

highs, closing at 56.38 US cents. (more)

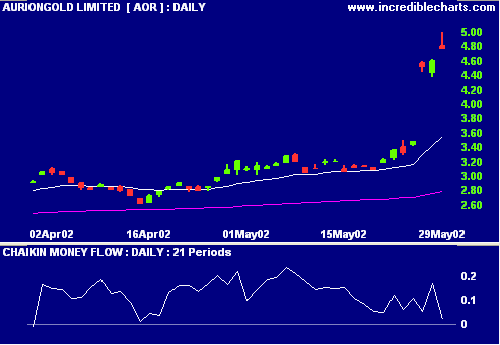

AurionGold makes further gains [AOR]

AurionGold reached $5.00

before falling back to close at $4.77. The weak close caused a

dip in the Chaikin Money Flow index.

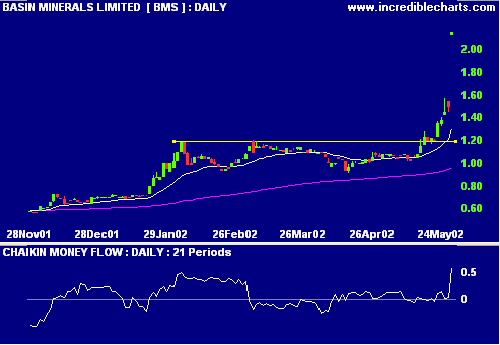

Basin Minerals [ILU]

Shares in the mineral sands explorer soared to

$2.15 after a takeover bid by rival Iluka Resources.

(more)

Relative Strength (price ratio: xao) and MACD

are strong, with Chaikin MF showing steady accumulation over

the last 2 months. BMS breakout above $1.20 resistance took

place last week.

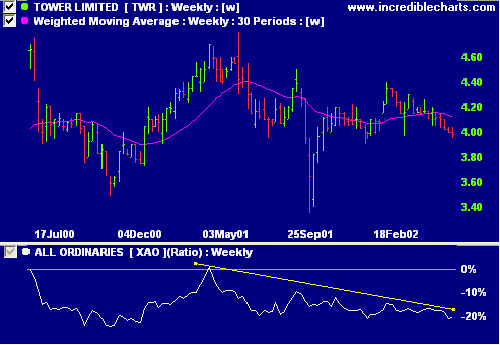

Tower

Tower is to investigate shifting its domicile

to Australia, predicting a market re-rating after cost savings

and growth initiatives. (more)

Relative Strength (price ratio: xao) and MACD

are weak, while Chaikin MF has crossed above zero, signaling

accumulation.

Conclusion

Short-term: Long - Stochastic and MACD are above

their signal lines. Maintain tight stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.