Trading Diary

May 23, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied in the afternoon to close up

0.5% at 10216 on normal volume.

The primary trend is down, secondary - up and

short trend - up.

The Nasdaq Composite gained 1.4% to close at 1697.

The primary cycle base is weak with the index

starting to trend downwards, the secondary trend is down, while

the short trend is up.

The S&P 500 climbed 1% to close at

1097.

Primary cycle base still shows weakness,

secondary trend - down and short cycle - up.

Durable goods up 1.1%

Durable goods orders for April were up 1.1%,

according to the US Commerce Department. (more)

3M adheres to targets

The adhesives, abrasives and specialty

chemicals manufacturer will meet its second-quarter earnings

targets and expects to achieve double-digit growth over the

next two years.

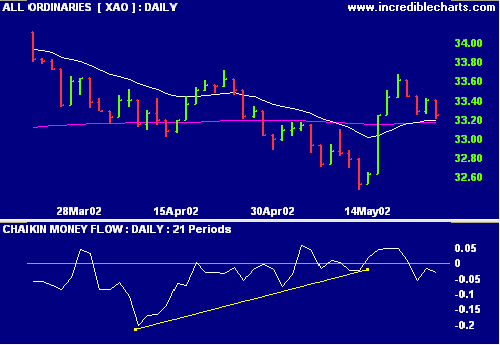

ASX Australia

The All Ords closed down 16 points at 3325 on

normal volume.

The primary trend is up, secondary - down and

short trend - up.

Chaikin Money Flow remains below zero,

signaling distribution.

Slow Stochastic (20,3,3) is below its signal

line.

The dollar takes a rest

The dollar closed yesterday at 55.68 US cents

after 3 days of strong gains. (more)

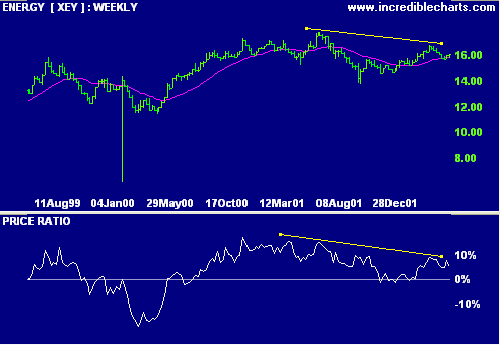

Oil and Gas

Oil and gas exploration is booming, according

to recruitment specialists. (more)

Chaikin Money Flow for the energy sector shows

strong accumulation, while Relative Strength (price ratio: xao)

remains weak.

Price Attack

New Clicks, the South African parent company of

Priceline, is to buy hair-care products company Price Attack with

94 stores. (more)

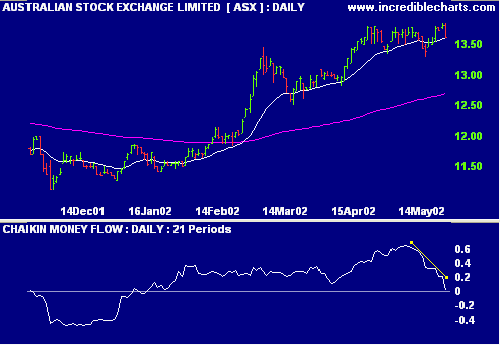

ASX to launch electricity futures [ASX]

The ASX is to launch its first commodity futures

in competition with the SFE. (more)

ASX Chaikin Money Flow shows a sharp decline

over the last 2 weeks, MACD show a bearish divergence, while

Relative Strength (price ratio: xao) is still strong.

Conclusion

Short-term: Avoid new entries. Maintain tight

stop-losses.

Medium-term: The All Ords has not yet formed a

base.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.