Trading Diary

May 20, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell 1.2% to 10229 on low volume. A

fall below 9750 would signal the start of a down-trend on the

secondary cycle.

The primary trend is down, secondary - up and

short trend - up.

The Nasdaq Composite dropped 2.3% to close at 1701.

The primary cycle is forming a base (or stage

1), secondary trend - down, while the short trend is up.

The S&P 500 fell 1.3% to close at 1081. The

target of 960 from the double top pattern may still be

attainable.

Primary cycle - the base still shows weakness,

secondary trend - down and short cycle - up.

All that glitters is Gold

June delivery gold futures trade as high as $US

316.70 per ounce. (more)

Stocks decline on fears of terrorism and

economic indicators

VP Dick Cheney describes further terrorist

attacks as "almost certain", while leading economic indicators

are down 0.4%. (more)

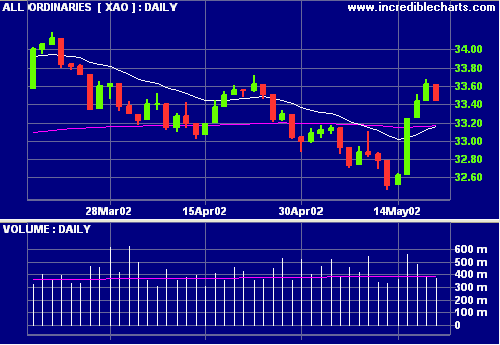

ASX Australia

The All Ords closed down at 3345 on normal

volume.

MACD* (26,12,9) and Slow Stochastic (20,3,3)

are still above their signal lines.

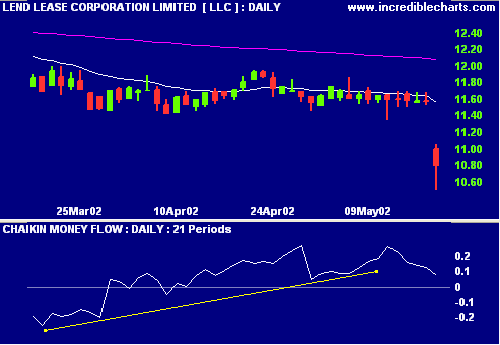

Lend Lease [LLC]

CEO David Higgins is to depart as the group looks for new stimulus. (more)

LLC fell sharply to close at $10.80 on strong volume. MACD and Relative Strength have been weak while Chaikin MF has shown accumulation - emphasizing the need for more than one indicator.

CEO David Higgins is to depart as the group looks for new stimulus. (more)

LLC fell sharply to close at $10.80 on strong volume. MACD and Relative Strength have been weak while Chaikin MF has shown accumulation - emphasizing the need for more than one indicator.

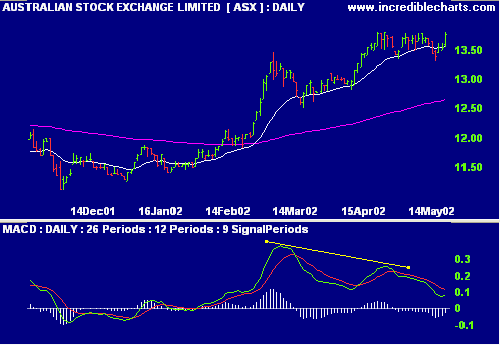

ASX [ASX]

The ASX now offers rebates and lower fees to

attract SFE derivatives traders to its new futures platform.

(more)

Chaikin Money Flow shows strong accumulation

since February but MACD now shows a bearish divergence.

Conclusion

Short-term: Long if

trailing buy-stops. Maintain tight

stop-losses.

Medium-term: The All Ords has not yet formed a

base.

Long-term: Wait for the Nasdaq or S&P 500

to break out from their bases (trading ranges).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.