Trading Diary

May 16, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow recovered to 10289 on normal

volume.

The primary trend is down, secondary - up and

short trend - up.

The Nasdaq Composite formed an inside day, with a slight gain to 1730.

The primary cycle is forming a base (or stage

1), secondary trend - down, while the short trend is up.

The S&P 500 gained 7 points to close at

1098.

Primary cycle - the base still shows weakness,

secondary trend - down and short cycle - up.

Dell Computers

Dell reported April-quarter earnings of 17 US

cents per share, the same as last year, compared to an expected

16 US cents. Sales were largely unchanged at $US 8 billion.

(more)

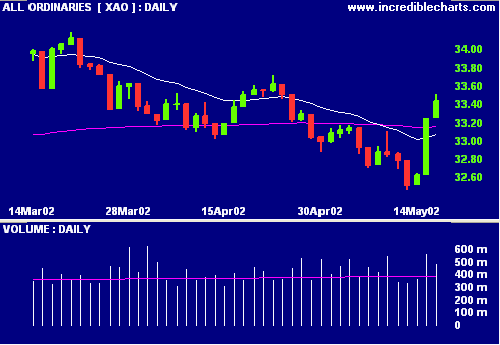

ASX Australia

The All Ords had another strong day, closing at

3343 on strong volume.

MACD (26,12,9) and Slow Stochastic (20,3,3) are

both above their signal lines.

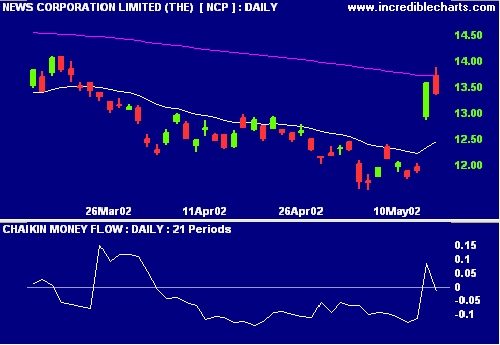

NewsCorp [NCP]

Vivendi threatens to withdraw from the purchase of NewsCorp

pay-TV assets in Italy. (more)

NCP

climbed in the morning session before retreating to close 19

cents down on strong volume.

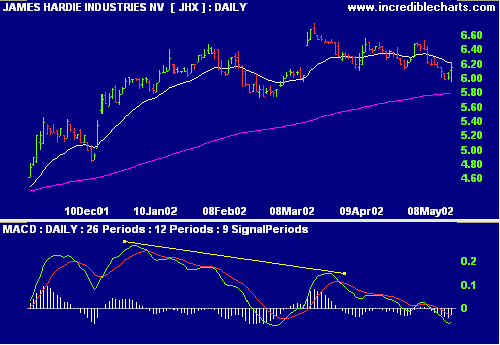

James Hardie [HDX]

The fiber cement company will

make a capital return to shareholders, from the sale of its

gypsum business. Fourth-quarter earnings were strong despite

annual earnings falling 23%. (more)

MACD and Chaikin Money Flow show

weakness.

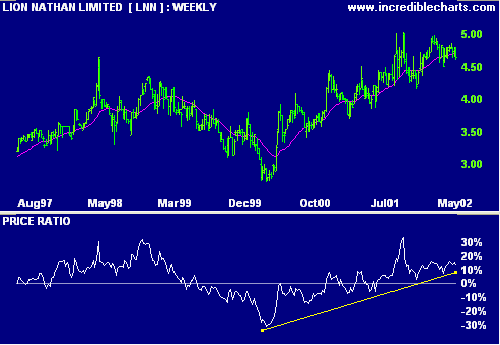

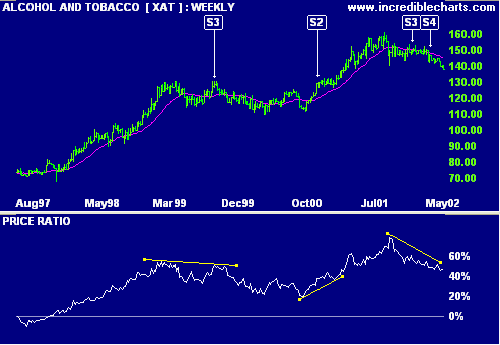

Lion Nathan [LNN]

The brewer reported a 12.5%

increase in first-half earnings. (more)

Relative strength (price ratio: XAO) is increasing but the sector index (XAT) shows a stage 4 decline.

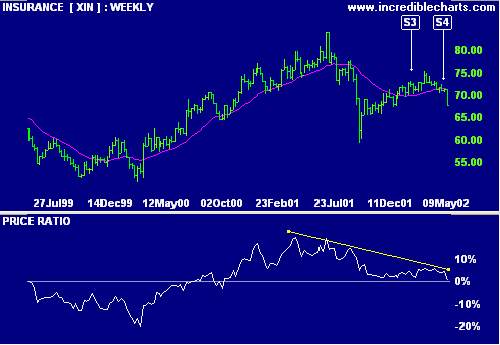

Insurance shakeout

A PriceWaterhouseCoopers

report warns that the industry faces rationalization and only a

handful of insurers will survive. (more)

Relative strength (price ratio: All Ords) and

the 30-week weighted moving average show the sector in a stage 4

decline.

Conclusion

Short-term: The rally may not be able to sustain

itself: long using

trailing buy-stops. Maintain tight stop-losses.

Medium-term: The All Ords has not yet formed a

base.

Long-term: Wait for the Nasdaq or S&P 500

to break out from their bases (trading ranges).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.