Trading Diary

May 8, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

It is not very often that you witness a 3% jump

on the Dow. The average rose strongly throughout the day to close

at 10141. The secondary cycle up-trend is intact.

The Nasdaq Composite soared almost 8% on the back of strong results from Cisco. "One sparrow does not make a summer" - the secondary cycle is still in a down-trend.

The S&P 500 climbed 3.75% to 1088. We will

have to wait and see whether the index again tests the 1070

level.

Cisco fever

Cisco Systems rose 24% since it topped analysts

quarterly estimates, restoring investors faith in chip and

hardware stocks. (more)

Rally needs to break above resistance

The short-term rally needs to

break above resistance levels if it is to sustain itself.

(more)

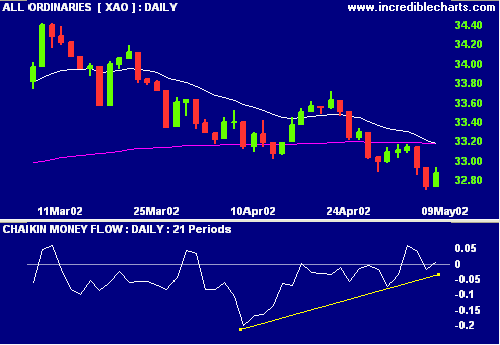

ASX Australia

The All Ords recovered to 3287 on reasonable

volume. The target for the correction is 3230 to 3240.

While Slow Stochastic and MACD are negative,

Chaikin Money Flow is showing a bullish divergence.

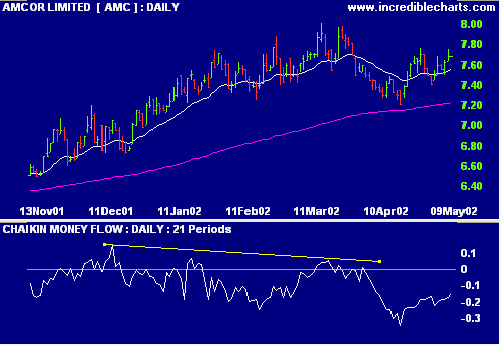

Amcor [AMC]

Amcor Limited becomes the

world's largest plastic bottle maker after its $2.875 billion

German acquisition. (more)

Chaikin Money Flow and MACD have both been

signaling weakness since early this year.

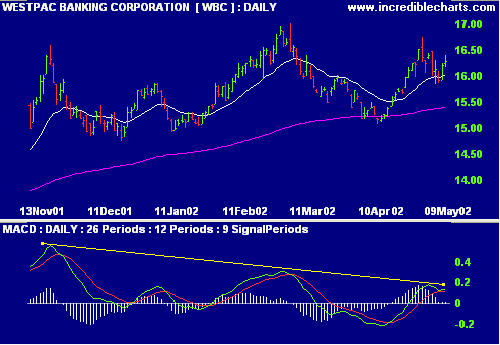

Westpac [WBC]

The ACCC approves the sale of

Westpac's AGC consumer finance division to GE Capital. Westpac

will use part of the proceeds to fund a share buy-back.

(more)

Chaikin Money Flow shows accumulation in April

but MACD is still weak.

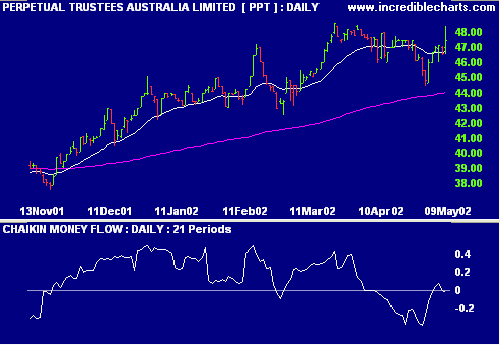

Perpetual declares special dividend [PPT]

Perpetual Trustees Australia

has shown its confidence in the company's outlook, declaring a

special dividend of 50 cents and promising another next

year. (more) Both Chaikin MF

and MACD have recently been showing weakness after a long period

of accumulation.

Conclusion

Short-term: Avoid long.

Medium-term: Wait for the All Ords to form a

base.

Long-term: Wait for the Nasdaq or S&P 500 to

form a base.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.