Trading Diary

April 08, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow continues it short-term down trend, closing at 10249 on

good volume.

The Nasdaq Composite index completed a closing price reversal day , closing up at 1785 - a possible trough on the intermediate cycle.

The Nasdaq Composite index completed a closing price reversal day , closing up at 1785 - a possible trough on the intermediate cycle.

The S&P 500 is still ranging between 1070 and 1180, closing

up slightly at 1125.

Blue Monday

Compaq more upbeat

HP's merger partner

issues an upbeat forecast, fuelling a late recovery.

(more)

Australia - ASX

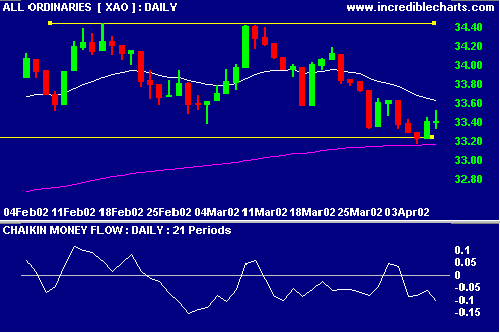

The All Ords closed unchanged at 3340 on low volume.

The low close in relation to the daily range signals

a possible reversal, while Chaikin Money Flow (below zero

for most of March) confirms that distribution is

taking place.

The MACD is still below its signal line.

Coles Myer [CML]

Newcrest [NCM]

Conclusion

Short-term: Avoid long.

Medium-term: Wait for a new high on the All Ords.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.