Trading Diary

April 03, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow fell more than 1% to close at 10198 on strong volume,

confirming that the short cycle is in a down-trend.

The Nasdaq Composite index closed down a further 1% at 1784, continuing its short cycle down-trend.

The Nasdaq Composite index closed down a further 1% at 1784, continuing its short cycle down-trend.

The S&P 500 also confirmed the start of a down-trend on the

short cycle, closing at 1125.

Hopes of a second-half recovery fade

Australia - ASX

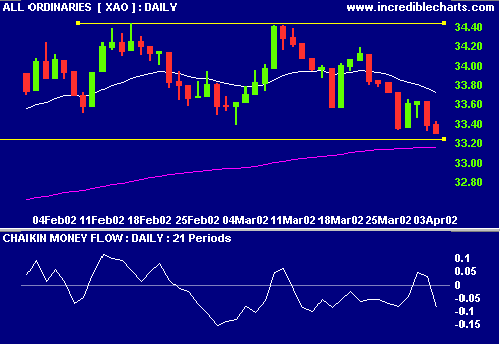

The All Ords closed lower at 3329 on very high

volume. Chaikin Money Flow has spent most of March below

zero, signaling that distribution is taking

place. MACD and Slow Stochastic are below their

signal lines.

Interest rates affect the dollar

Newscorp stock falls 3% [NCP]

The media group faces a US$ 5 billion valuation shortfall on

its investment in television guide technology company, Gemstar.

(more)

Conclusion

Short-term: Avoid long.

Medium-term: Wait for a new high on the All Ords.

Long-term: Wait for the Nasdaq or S&P 500 to

break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.