Trading Diary

April 02, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

With Middle East tensions casting a shadow over the market, the

Dow slipped further to close at 10313 on regular

volume.

A slew of profit warnings from software companies caused the Nasdaq Composite index to fall more than 3%, closing at 1804.

A slew of profit warnings from software companies caused the Nasdaq Composite index to fall more than 3%, closing at 1804.

The S&P 500 retreated 0.85% to close at 1136.

Australia - ASX

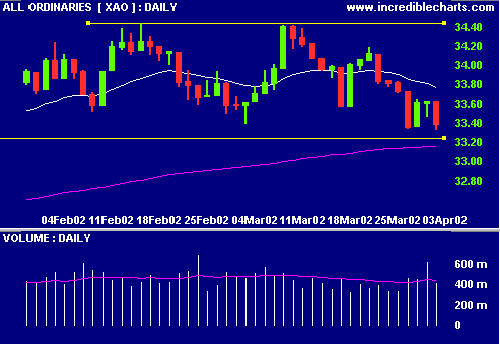

The All Ords closed down at 3338 on normal volume. The MACD and

Slow Stochastic are below their signal lines.

Interest rates

Lihir [LHG]

Sectors: Miscellaneous Industrials

A stock screen of XMI sectors turned up the following

candidates for my watchlist:

-

Melbourne IT (MLB)

-

Quiktrak (QTK)

-

SMS Management (SMX)

The screen used a 10-day and 150-day Moving Average Crossover plus 150% Volume Spike.

Conclusion

Short-term: Avoid long until we see a

rally.

Medium-term: Wait for a new high on the All Ords.

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.