Trading Diary

March 25, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow closed down 1.4% at 10281 on low volume, below the

10300 support level. Still in an intermediate up-trend.

The Nasdaq Composite index closed down more than 2% at 1812. The intermediate trend is down.

The Nasdaq Composite index closed down more than 2% at 1812. The intermediate trend is down.

The S&P 500 closed down 1.4% at 1131. The index

is ranging between 1070 and 1180.

Tech stocks and banks lead the retreat

Concerns about further earnings disappointments forced tech and

banking stocks lower, with only gold edging higher.

(more)

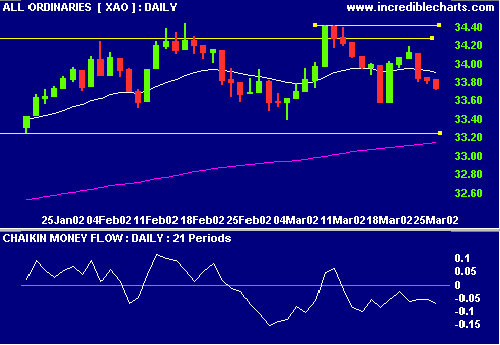

Australia - ASX

The All Ords closed down at 3373 on low volume. The MACD and

Slow Stochastic are below their signal lines.

Gold

Sectors: Gold

XGO is rising steeply, above its 30-week weighted moving

average, while 3-year relative strength (price ratio) has

crossed into positive territory. Short-term trades if price

rises above 13.15.

Conclusion

Short-term: Avoid new positions.

Medium-term: Wait for a new high on the All Ords.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.