Trading Diary

March 1, 2002

These extracts from my daily

stock trading diary are intended to illustrate the techniques

used in short-term share trading and should not be interpreted

as investment advice. Full terms and conditions can be found

at

Terms of Use .

USA

The Dow rocketed up 2.6% to close at 10368 on strong volume.

The break above the high of early January signals that the

up-trend is likely to continue. If the index can maintain at

this level over the week ahead - the next major resistance

level is 11500.

The Nasdaq Composite index rose 4.1% to close at 1802. The

down-trend is weakening but has not yet reversed.

Manufacturing sector improves

A key (ISM) manufacturing sector index jumped to

54.7% from 49.9% in January, the first increase in 19

months. (more)

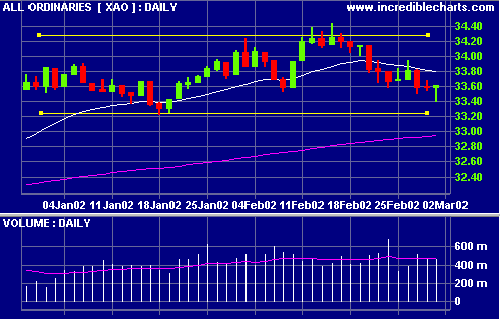

Australia - ASX

The All Ords recovered from early losses to close up slightly,

at 3362 on strong volume. The MACD and Slow Stochastic

are still below their signal lines. Expect a reaction on

Monday to the positive news from the US.

IAG [IAG]

The former NRMA Insurance Group returned to profit, reporting a

net profit of $49 million for the half-year. (more)

Conclusion

Short-term: Avoid new entries until there are positive signals

from the MACD and Slow Stochastic.

Medium-term: Wait for a new high on the All Ords

Long-term: Look for a reversal on the Nasdaq or S&P 500.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back Issues

Access the Trading Diary Archives.