Trading Diary

January 31,

2002

These extracts from

my daily stock trading diary are intended to illustrate the

techniques used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The Dow climbed another 1.6% to close

at 9920 on strong volume, while the Nasdaq 100 made a

weaker rally, to 1550.

P&G

Disney

Walt Disney Co.

reported a more than 50% drop in first quarter earnings,

excluding one-off items, on a 5% fall in revenue.

(more)

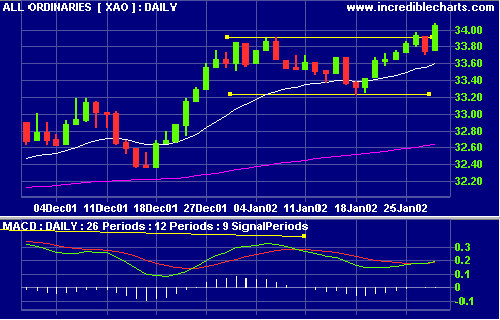

Australia - ASX

The All Ords rose strongly to close at

3404 on good volume, near to its high of 3425.

The MACD has crossed to above its signal line, signaling a

market entry point. Coming so soon after a bearish

divergence, it will pay to be cautious and only enter

trades where stop losses can be placed within tight

limits.

Computershare

[CPU]

Lang Corp and

Toll [TOL]

The pair's National

Rail Consortium will acquire FreightCorp and National

Rail for $1.05 billion. (more)

Conclusion

Short-term: The MACD has signaled a market entry

point. Approach the market with caution as the MACD

has just completed a bearish divergence.

Only take trades where stop losses can be set within

tight limits.

Long-term: Wait for a correction on

the

secondary cycle.

Colin Twiggs

P.S. We are trying out new software.

Please report if you experience any display problems with

the trading diary.

Please forward this to your friends and colleagues.

To be included on our mailing list, reply

to this Email adding MAIL ME to the subject

title. All details submitted are protected by our

Privacy Policy.

Back Issues

Back Issues

Access the Trading Diary Archives.