Trading Diary

January 23,

2002

These extracts from

my daily stock trading diary are intended to illustrate the

techniques used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The Dow closed up slightly at 9730 on

reasonable volume - another

inside day above the 9650 -

9700 support level showing that buyers and sellers are

uncertain about the direction of the market. The

Nasdaq 100 also posted an inside day, rising 3%, but the

down-trend continues.

Chip stocks

Signs of improving demand in the

semiconductor field but the big money stays out of the

market. (more)

AOL Time Warner

AOL has to convert more subscribers to

broadband and penetrate the European market in order

to sustain its growth. (more)

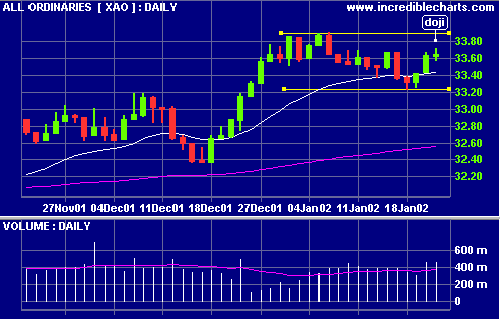

Australia - ASX

More uncertainty as the All Ords closed

almost unchanged at 3364 on strong volume.

The doji

star candlestick parttern is a mild reversal

signal (the

doji indicates

uncertainty).

No more rate

cuts?

December quarter inflation at 0.9% is

almost double market expectations, making further rate

cuts unlikely and sending bond yields

soaring. (more)

Conclusion

Short-term: Wait for the MACD or MACD Histogram to signal

an entry point.

Long-term trades: Wait for a correction on

the

secondary cycle.

Colin Twiggs

P.S. Please report if you experience any

display problems with the trading diary.

Please forward this to your friends and colleagues.

To be included on our mailing list, reply

to this Email adding MAIL ME to the subject

title. All details submitted are protected by our

Privacy Policy.

Back Issues

Back Issues

Access the Trading Diary Archives.