Trading Diary

January 21,

2002

These extracts from my daily stock

trading diary are intended to illustrate the techniques

used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The NYSE and Nasdaq were closed Monday, in observance of

Martin Luther King Jr. Day.

On Friday the Dow fell to 9771. The week ahead will tell whether there is sufficient selling pressure to breach the 9650 - 9700 support level of the last month.

On Friday the Dow fell to 9771. The week ahead will tell whether there is sufficient selling pressure to breach the 9650 - 9700 support level of the last month.

Intel

Intel posted a 20% revenue drop in the 4th

quarter and warns that things may get worse before they

improve. Some speculators take this as a buy signal.

(more)

Australia - ASX

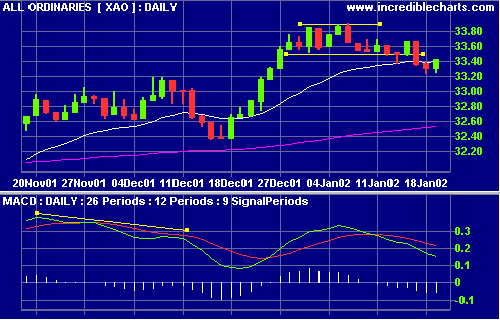

The All Ords recovered slightly to 3343 on light volume.

The MACD still shows a bear signal.

Woolworths

Short-term: Buyers should stay clear of the market.

Long-term trades: Wait for a correction on

the

secondary cycle.

Colin Twiggs

Please forward this to your friends and colleagues.

To be included on our mailing list, reply

to this Email adding MAIL ME to the subject

title. All details submitted are protected by our

Privacy Policy.

Back Issues

Back Issues

Access the Trading Diary Archives.