Trading Diary

January 2, 2002

These extracts from my daily stock

trading diary are intended to illustrate the techniques used in

short-term share trading and should not be interpreted as

investment advice. Full terms and conditions can be found

at

Terms of Use .

USA

The Dow rallied late in the day to close at 10073 on normal

volume. It may well test resistance formed at 10200, the level

of the previous high. The bearish MACD

divergence continues.

The Nasdaq rallied 2% to close at 1610, but is still in

a down-trend

, only reversed if the index rises above 1640.

K-mart falls 18%

K-mart stocks fell on reports of disappointing December sales.

(more)

Instinet, retail industry analysts, project stronger retail industry sales but "further damage to already weakened margins" due to mark-downs and special promotions.

Instinet, retail industry analysts, project stronger retail industry sales but "further damage to already weakened margins" due to mark-downs and special promotions.

Australia - ASX

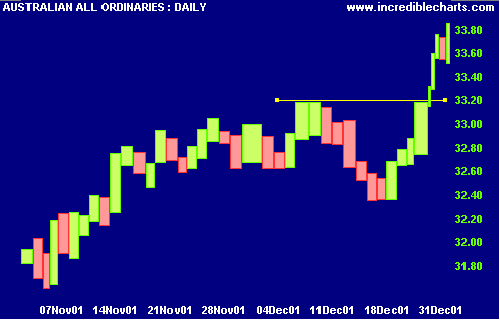

The All Ords continued to climb, closing at 3384 but

on very weak volume*. This is best illustrated on an Equivolume

chart where the thickness of the bars represents volume*. Since

the break above 3320, on December 24th, volumes have been

exceedingly weak, indicating that a correction is likely.

* When we refer to "volume" in relation to an index, we

actually measure the total value traded. This is a more

accurate reflection of market activity.

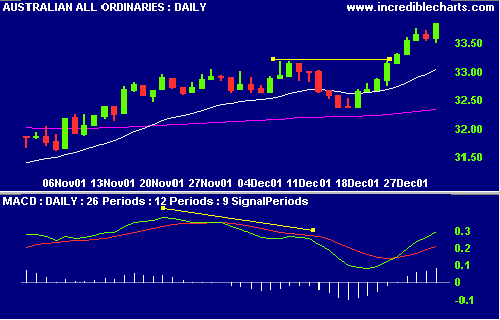

The bearish divergence on the MACD

has been broken, with MACD rising above the last peak. But

MACD does not take volume into account and MACD divergences

are powerful signals, seldom wrong. So I am still

anticipating a downward correction.

Conclusion

This is beginning to sound like my daily mantra. Just

remember that you don't make money by buying stocks when they

have a 50/50 chance of going up or down. We have to wait until

the odds are more like 70/30 in our favor.

Short-term: The Dow still shows weakness and the

Nasdaq is in a down-trend. Tighten up on stop

losses and avoid new entries.

Long-term trades: Wait for a correction on the

secondary cycle.

Colin Twiggs

Please forward this to your friends and colleagues.

To be included on our mailing list, reply to

this Email adding MAIL ME to the subject title. All

details submitted are protected by our

Privacy Policy.

Back Issues

Back Issues

Access the Trading Diary Archives.