Trading Diary

November 15, 2001

This is my daily short-term stock

trading diary. It is intended to illustrate the

techniques used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The recent rally is losing steam with the Dow closing up 40

points but on an

inside day, with a lower high

than yesterday.

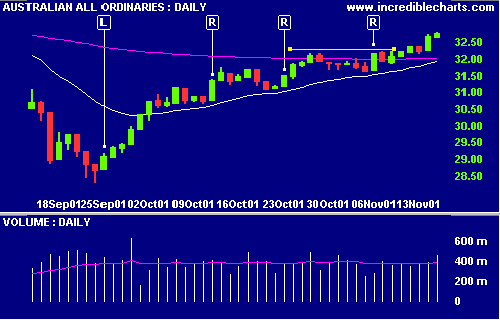

Australia (ASX)

The All Ords experienced a bit more selling pressure, closing

up slightly at 3276 on increased volume.

Selecting Stocks

I use a 3 point process to select stocks for further study:

-

I use the Stock Screen to rank indices based on their 3-year % Price Move, with a minimum of 50% growth, eliminating any index with a 6-month % Price Move less than zero.

The ranking showed 4 sectors: Healthcare & Biotech; Banks & Finance; and Building Materials. I eliminated Building Materials as the sector tends to be cyclical. -

Using the same selection criteria, this time on All Sectors, highlight groups of stocks that may have fallen through the net.

Quite a few wine stocks showed up, so I added Vintners to the list of Sectors for Step 3. -

I then screen each of the Sectors making up the selected indices, using the same selection criteria as in step 1.

Example: Vintners - Brian McGuigan, Petaluma, Peter Lehmann and BRL Hardy were selected.

(Tip: If you are screening a sector for the first time, right-click on the Stock Screen Results and save the list as a new Watchlist)

Conclusion

Short-term trades: use

trailing buy-stops to enter

trades and ensure that stop

losses are placed within the 2% maximum

acceptable loss.

Long-term trades: Wait for a pull-back on the

secondary cycle.

Colin Twiggs

-

Please forward this to your friends or colleagues.

-

To be included on our mailing list, reply to this Email adding MAIL ME to the subject title. All details submitted are protected by our Privacy Policy.

Back Issues

Access the Trading Diary Archives.